Claiming your J1 Tax Back

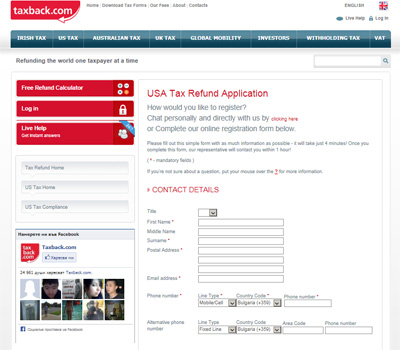

You can apply for your taxback online via our partner TaxBack.com generic emsam .

Their service staff will help you fill out the forms and claim your the tax that you are owed, all in a manner that is really friendly and helpful.

First start off with selecting your nationality, and then the country you want to apply for taxback. You can claim a tax return if you worked in the United States between 2013 – 2016.

Then you will be required to fill out some basic details and they will apply on your behalf.

So there isn’t a need to fill out any complex paper work. TaxBack.com will then track your tax return and will deal with the necessary agencies. It costs $60 for preparing Federal tax claims & $30 for State tax. But with the average return in the region of $800, it is well worth the price.